Certified Experts

Not everyone becomes an Expert! To join Visory our Experts must live in Australia or New Zealand and meet rigorous recruitment, training and certification standards.

Industry Specialised Teams

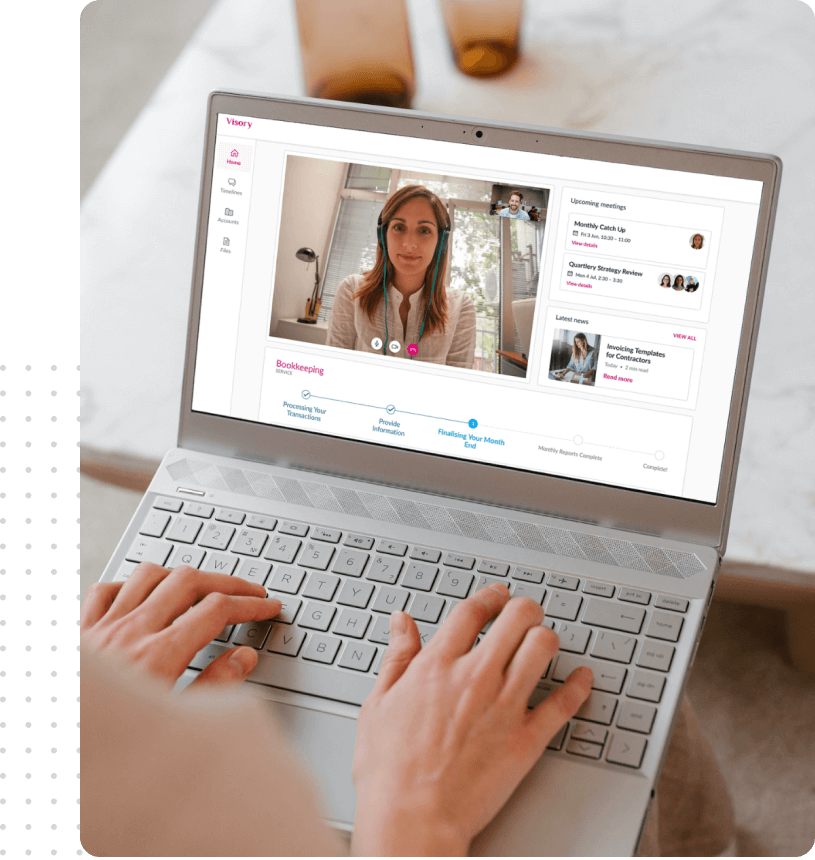

Our marketplace of Experts are structured into industry specialised teams to ensure you receive the right support. Each team has technical leads, customer managers and finance experts all working together to deliver your service.

Quality Assurances & Safeguards

Our platform goes that extra mile with automations cross-checking invoice details, verifying transactions and monitoring service delivery at every stage to guarantee quality.